The COVID-19 pandemic slashed the restaurant workforce in half overnight in April 2020, when indoor dining closed. The leisure and hospitality industry employed over 13,200 people in the Bend-Redmond metro in March 2020, plummeting to just over 6,000 the next month, according to the U.S. Bureau of Labor Statistics. The industry quickly regained some of its workforce, but its employment numbers still lagged behind the previous five years. August 2018 saw that year's high at 14,600 hospitality workers. At its peak employment in August 2019, the Bend-Redmond hospitality industry employed 15,000. August 2020 totals were at 12,500 then 14,000 in 2021 and 14,300 in 2022.

In 2023, hospitality sectors employed more people in January and February than they did during the peak in 2020, but three years later, restauranteurs are still dealing with downstream impacts of COVID and lockdowns.

Despite employment being close to pre-pandemic levels, restauranteurs still report issues attracting and retaining a workforce. The Oregon Employment Department found nearly 12,000 job vacancies in the leisure and hospitality sector statewide in winter 2022. Jason Brandt, president and CEO of the Oregon Restaurant and Lodging Association, estimates that the true number of vacancies could be closer to 20,000 in a sector that already employs 180,000 people in Oregon.

"We are the second largest private-sector employer behind health care in the number of paychecks we create and provide to Oregonians. But we probably have the demand and customer service needs to employ 200,000 Oregonians right now, as opposed to 180,000," Brandt said.

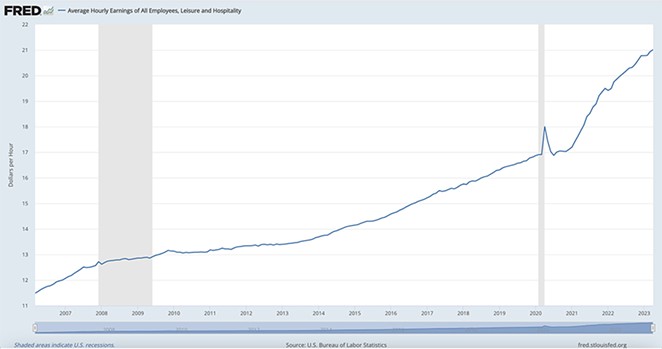

The cost of hiring new employees rose sharply after the pandemic. The Federal Reserve reports an average hourly wage of $21 in April 2023 for restaurant workers, up from about $17 immediately pre-pandemic.

Restaurants operate in an industry with high turnover rates due to the seasonality of the business and the fact that adolescents make up a good chunk of the workforce. A study by 7Shifts found the average tenure of a restaurant employee is 56 days, and that nearly 2/3 workers will leave within a year. During the pandemic turnover rates rose to 75%. Employees cite wages and demanding schedules as key factors in seeking new work.

"We have taken more time, probably to our detriment, as far as working around people's schedules and making sure that we run really lean," said Jon Weber, owner of J-Dub in downtown Bend. "Anyone that's on shift here tends to make money. In the service industry good servers go where they get paid, so we run as lean as possible."

Cost of doing business

Restaurants generally have low profit margins, usually somewhere between 3-5%. Labor is the highest expense, but rent and food costs are also significant expenses.

"Those cost centers, they're all volatile. So, every, every restaurant owner I have a chance to engage with — and we have thousands of members across the state, they're anxious about all three of those areas," Brandt said.

New restaurants often need to significantly upgrade a building to get cooking. Restaurants need a commercial grade kitchen, seating and equipment. System development charges, levied on properties that change how their use, remain, even if a commercial space goes from retail to a restaurant and back to retail. For that reason, most spaces that become restaurants, stay restaurants, even under new ownership.

"Once you get a restaurant in a spot, generally, you see it as a restaurant. You wouldn't, as an owner, move back to a retail space because you'd still be paying higher fees," Weber said. "I have seen people take advantage and raise rates downtown. I have seen some people paying ridiculous rates, even on the east side of town, with a per square foot price that I wouldn't touch."

The number of restaurants in Bend rebounded to pre-pandemic levels of about 320 by 2022, according to former regional economist Damon Runberg, but some of the restaurants aren't necessarily the same. Seasoned restauranteurs with money to spend will often seek out buildings that can already accommodate a food business, rather than building one from the ground up.

"If an owner is well capitalized, then they're in a very unique position in this marketplace to leverage some costs that have potentially been left behind by a previous restauranteur that used to occupy a specific space, because they can get that space for, in some cases, pennies on the dollars for what the previous restaurant tour had to pay for those capital improvements," Brandt said.

Retail food prices are up across nearly all categories, according to the United States Department of Agriculture. A lot of these changes are explained by supply chain disruptions, labor shortages and inflation — along with more specific variables like the spread of avian flu leading to higher prices for eggs. Weber said eggs went from costing 8 cents to 45 cents, and frier oil is nearly five times as expensive as it was before.

"I can't tell my customers that I just changed my prices for fries. So, you just have to absorb it. You don't really have a whole lot of choice on that one. Because if you start flipping menu prices, it costs money to change my menu; if you keep changing it you're beating yourself up just on reprinting menus," Weber said.

Weber said the price hikes tend to come in steps, and though it may stabilize closer to normal, prices aren't likely to ever come down to pre-pandemic levels. He's hesitant to change his menu in response to the prices, but Brandt of ORLA believes price hikes will become more normal as food costs become more variable. Nationwide, menu prices rose 8.6% over the last year, according to the National Restaurant Association.

"Without question, we're seeing more frequent changes to menus as just a normal course of business, just to make sure that the restaurant stays alive for the customers and for the community and for the people that work there," Brandt said. "I find that restaurant operators don't change their menus frequently enough given the volatility. With food costs, it probably will happen more frequently in the future to keep pace with the hard costs that just are unsustainable if you're not willing to change your price structures."

The New Normal

"I've had to raise my takeaway prices because I'm not getting that beer sale. The margins on food are slim, and I make up for it on the other side with sales of alcohol or soft drinks. That takeaway mentality limits some of our sales," Weber of J-DUB said.

The winter tourism season in Bend was also underwhelming for many in the food service industry. Though the powder on the mountain was good, and several recreation businesses prospered, that success didn't translate to food service, Brandt said.

"Ski season, just like the summer season in Central Oregon, are key parts of the year that can truly make or break the success of a restaurant," Brandt said. "If we have storms that are somewhat out of our control that create a navigation problem to get to that fresh powder and enjoy the ski and snowboarding season, then that does directly impact the ability of restaurants to sustain their operation."

Though a lot has changed in the restaurant business, Weber said he's seen a positive trend lately. People aren't quite as skittish about coming into the restaurant, employee retention is up from the worst of the pandemic and more customers are becoming regulars.

"I've been in business 31 years, always in the restaurant industry. I do see people appreciate the fact that we're kind of a foodie town. I see a groundswell coming back. In some ways people are changing back. It's not the same as right before COVID, but we are seeing a nice uptick," Weber said. "It's taken a bit of time to get here, but I know my velocity is going up, which is kind of exciting after having to struggle through three years."